China is implementing what is expected to become the world's largest CO2 emissions trading system. To reduce emissions, the nation employs a tradable performance standard (TPS), a rate-based instrument differing significantly from cap&trade (C&T) and a carbon tax, emissions pricing instruments used elsewhere. With matching analytically and numerically solved models, we assess the cost-effectiveness and distributional impacts of China's TPS for reducing CO2 emissions from the power sector.

The TPS implicitly subsidizes electricity output, which limits the use of output-reduction as a channel for reducing emissions. It also gives power plants with especially low emissions-output ratios incentives to expand output relative to business-as-usual levels. These features compromise the TPS's cost-effectiveness relative to C&T. The use of differing benchmarks (emissions-intensity standards) also compromises cost-effectiveness by distorting relative production levels and by lowering the cost-reducing potential of allowance trading. In our central case simulations, the TPS's overall costs are about 34 percent higher than those of C&T.

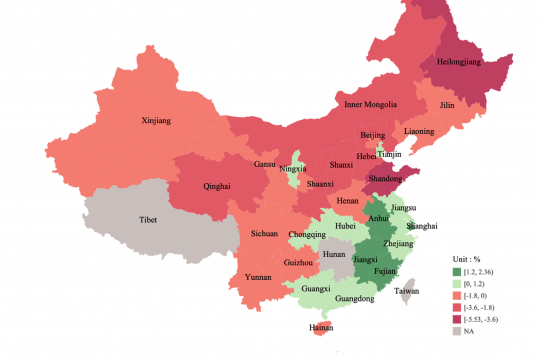

Although the use of non-uniform benchmarks compromises cost-effectiveness, it can help serve regional distributional objectives. We assess the aggregate costs of customizing benchmarks in order to reduce the adverse profit impacts in provinces that otherwise would suffer a disproportionate cost from the TPS.