Wednesday, November 3, 2021. It is Finance Day at COP26 in Glasgow. I enter the venue through one of the many gates in the fence surrounding the Blue Zone. Security personnel checks my badge and my daily Covid-test result before allowing me through.

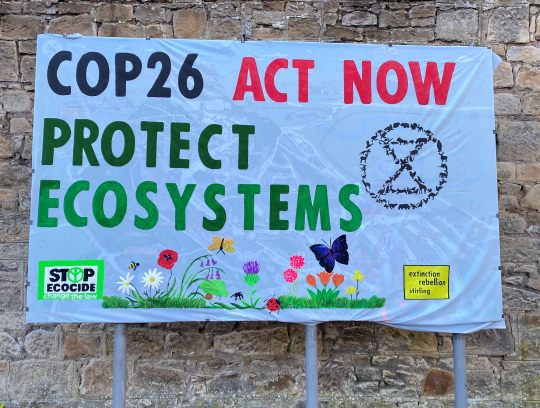

A short walk later, I enter the next step of security; the queues to the real deal airport-like security check. In the long line, I notice people with different badges such as “press”, “party” and “observers”. I think I even see a guy with a badge that says “climate activist”, but I am not sure. Most of the activists are outside the fence. Outside, urging world leaders and negotiators inside the Blue Zone to act - and to act now.

High-profiled participants and others

Today is Finance Day. Waiting in line, I wonder whether all high-profiled finance people that are expected to the COP26 today are also queuing in the same lines as the rest of us to get in. I would think not. There must be another entrance for the Mark Carneys and Larry Finks of the conference. But I haven’t seen it.

Initiative will unlock $130 trillion

Mark Carney is playing a leading role on Finance Day. He is the UN Special Envoy on Climate Action and Finance and presents one of Finance Day’s most high-profiled initiatives: the Glasgow Financial Alliance for Net Zero, GFANZ. The initiative will allegedly support unlocking $130 trillion of private finance aligned with net-zero emissions. That is a very large sum, hard to grasp. 130 million million.

When I search for more information about GFANZ after the announcement, I read on the initiative’s webpage that “unlocking systemic change will require collaborative, ambitious commitments and near-term action across the entire financial system.” I couldn’t agree more. Collaboration and cooperation between private and public actors are absolutely necessary to reach the temperature targets of the Paris Agreement.

Financial institutions must step up

Actually, most of the things I hear during the Finance Day are well in line with what I would agree to be crucial steps forward. This includes a global minimum disclosure standard for projects and investments supporting actors to correctly assess and compare climate risks, the need for financial institutions such as the European Investment Bank (see link below for the EIB press conference on this at COP26) to act as partners to build capacity and provide support to clients in making transition plans, as well as the role of financial institutions to provide knowledge regarding which activities are aligned with a decarbonized future and which activities that are not.

The devil is in the details

Still, I can’t shake off a feeling of cautiousness. A delegate from the World Bank points out that standards must be made appropriate and proportionate for developing countries. Otherwise, emerging markets will be left out, and the private capital flows will not be mobilized to support the transition in those countries. As usual, the devil is in the details. The continued work within the Glasgow Financial Alliance for Net Zero and on the global standard-setting is something to follow closely during the coming 2-3 years since this will likely have a significant impact on global capital flows in the coming decade and more.

Avoid the sucker effect

Also, something else bothers me… The feeling (a sentiment I think I share with many of the activists outside the fence of the Blue Zone) that if we are going to reach the temperature targets of the Paris Agreement, we need to trust individuals and actors such as banks, businesses, and high-level executives to cooperate, while historically, many of them have a track record of being more individualists and free-riders than cooperators.

My hope is set to “the conditional cooperator effect”. People tend to cooperate if they are assured that others are also cooperating. A global disclosure standard, if well designed, can reduce free-riding and help actors coordinate. If the initiatives and pledges announced on Finance Day can help transform free-riders and those that are afraid of the sucker effect (i.e. I cooperate when no one else does) into conditional cooperators, this may be a very important outcome in itself.

I leave the venue. It is dark outside and I like the idea that I don’t need to trust former free-riders to cooperate. I just need to trust that good policymaking and the mechanism of conditional cooperation works.

Åsa Löfgren is associate professor at the Department of economics at the University of Gothenburg, Head of the University of Gothenburg COP26 Observer Delegation, and Chair of the UGOT Centre for Collective Action Research.

Do you want to know more? Links to events or initiatives referred to in the blog:

The announcement of the Glasgow Financial Alliance for Net Zero Biggest financial players back net zero

The prototype for Net Zero Financing Roadmaps tool

The European Investment Bank press conference